Global equity markets were jolted lower last fall during a violent October filled with geopolitical risk, slowing growth and questions surrounding rich valuations in the technology sector. Investors were left wondering, “How can I reduce volatility in my stock portfolio?”

Enter foreign equities.

Believe it or not, foreign equities comprise nearly half of the global stock market. Historically, building a global equity portfolio—rather than one biased toward domestic stocks—has resulted in a smoother stream of returns over time. Among other factors, differences in sector weights, economic environments and political backdrops result in a non-perfect correlation between U.S. stock markets and foreign stock markets. Mathematically, these variances produce diversification benefits for portfolios and generate less extreme peaks and troughs.

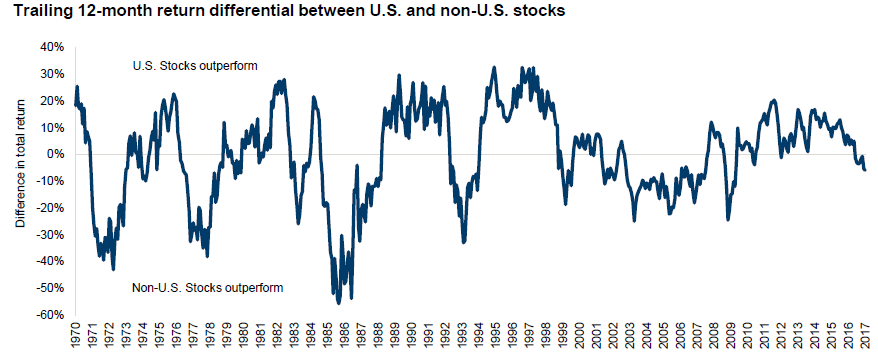

It is important to understand that market leadership does change over time, and sometimes wildly so. The combination of 2017 and 2018 is an excellent example. In 2017, domestic equities (as measured by the Russell 3000 Index) lagged foreign equities (as measured by the MSCI ACWI Ex USA NR USD Index) with a return of +21.13 percent versus +27.19 percent! In the first 10 months of 2018, U.S. stocks generated a total return of +2.43 percent versus a foreign stock return of -10.97 percent.

The post-2008 financial crisis period has seen a wide performance gap develop, with U.S. equities significantly outperforming their foreign counterparts. However, a longer look back through history demonstrates many periods of the foreign equity market’s relative strength.

Fundamental reasons, such as currency movements, often meaningfully drive performance differentials and warrant tactically overweighting or underweighting regions over time.

Additionally, domestic equity markets are typically more expensive than foreign markets when looking at valuation metrics like P/E ratios. Investors are willing to pay up for quality and certainty. More expensive can be justified. Would you pay the same for a Ford Fiesta as a Ford Mustang?

At the moment, U.S. equities appear more expensive than usual relative to foreign equities. That could perhaps lay the foundation for future foreign equity outperformance. In fact, long-term return estimates show a distinct return advantage in favor of foreign equities over the next decade. Is your portfolio biased? iBi

Patrick V. Masso, CFA, is vice president and investments team leader at Heartland Bank Wealth Management. For more ideas and discussion, contact the Heartland Bank Wealth Management Team or visit hbtbank.com/wealth-management.

Securities and insurance products are not deposits of Heartland Bank, are not FDIC insured, are not guaranteed by or obligations of the bank, are not insured by any government agency, and are subject to potential fluctuation in return. This information is not intended to be and should not be treated as legal advice. Readers should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific advice from their own counsel.