It takes time, focus, technology and dedication to keep up with ever-changing global economies and capital markets.

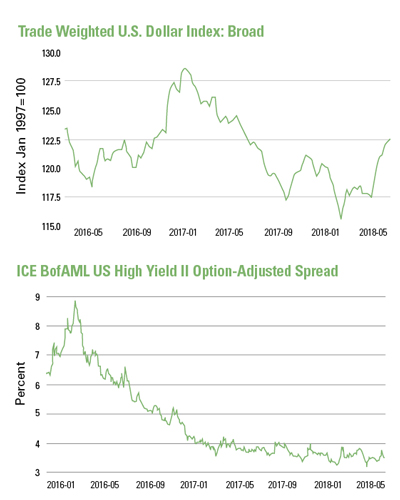

Foreign currency movements routinely impact the revenues and expenses of corporations—and have done so to an even greater extent over the last several decades of globalization. The U.S. dollar saw a huge increase between mid-2011 and the end of 2016. In contrast, the dollar declined nearly seven percent in 2017. Since August 2017, however, the dollar has managed to stop the decline and trade in a sideways range. In mid-April 2018, the U.S. currency began a significant push higher.

These currency movements are represented graphically on the corresponding charts. The first chart shows the trade-weighted U.S. dollar and its fluctuations over the last two years. The second chart explores high-yield bond spreads during that same timeframe. But what exactly does this mean for you?

Economies across the globe have begun diverging in recent months. This is in stark contrast to the last year and a half, when growth across all economies had been accelerating in unison. A divergence in growth has historically been supportive of the U.S. dollar, and it’s probable this will remain the case for the rest of 2018.

A stronger dollar typically has a meaningful impact on investments denominated in other currencies, such as emerging market bonds and foreign stocks. U.S. equities have generated a material level of outperformance relative to foreign equities in 2018. Emerging market bonds have struggled.

Let’s switch gears to the high-yield bond market. It tends to perform strongly when the economy is chugging along and the risk of borrowers defaulting on loans is, therefore, low. The additional yield, or “spread,” from investing in these riskier bonds has been reduced a bit more since August 2017 and has vacillated between 3.2 and 4.0 percent in the months since then. We chose not to overstay our welcome and have reduced exposure to this category in 2018.

Whether it’s changes in currency movements or shifts in a certain pocket of the bond market, Heartland Bank philosophically believes in enhancing risk-adjusted returns for clients through tactical asset allocation. Sometimes it’s not about what you want to own, but what you don’t want to own—or at least own less.

It takes time, focus, technology and dedication to perform a “rinse and repeat” process of analyzing global economies and capital markets each week. Make sure your bank is staffed with dedicated individuals who are detailed and thorough in their market analysis. If they are committed to evaluating these ever-changing economic trends, that means, in turn, they are committed to you. iBi

Patrick V. Masso, CFA, is vice president and investments team leader at Heartland Bank and Trust Company.