“If we can massage solutions into the present system, I think that when we get done, we will have a much better system.”

—Mike Kepple, president of Kepple & Company, in InterBusiness Issues, July 1991

Nearly 20 years later, healthcare costs have increased from approximately $2,800 per year per capita to about $8,500 per year per capita—a greater than 300-percent increase—while the population has increased 24 percent. At the same time, healthcare expenditures as a percentage of GDP have increased from approximately 12 percent to 17.5 percent. And Mike Kepple is still dealing with healthcare cost issues, and the government is still determined to fix it.

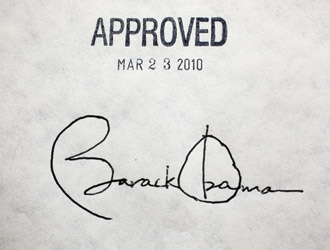

The Patient Protection and Affordable Care Act (PPACA) meets one of its two original goals—that all Americans will be covered. However, it missed the goal of controlling costs by light years, projecting costs of $4.6 trillion by 2020, which assumes a decrease in physician reimbursements for Medicare. Today, we ask ourselves: Can we massage the healthcare system signed into law on March 23, 2010, or do we throw it out and start over? We will explore some of the positive aspects of the legislation, as well as areas in which massaging needs to take place, especially in controlling costs.

THE GOOD

The PPACA has some good points that could be positive for Americans if implemented properly:

Standardized healthcare plan. Medicare recipients have benefited from a standard set of plan coverages; participants have not had to shop several insurance carriers to determine if their needs are met. Individuals not covered by Medicare must frequently compare plans of many insurance carriers, often with inadequate information. According to current law, by 2014 an “essential health benefits package” will be established throughout the land for everyone. This should significantly reduce the time that physicians, office staff and other providers spend dealing with insurance companies regarding what is and is not covered. There will be four different levels of premiums, but the plan will be universal.

Everyone is covered. It is interesting that the number of uninsured—often quoted during the 2008 presidential campaign as 47 million or 50 million—was reduced to 32 million under healthcare reform when it was limited to American citizens. In our book, Reasoned Health Care Reform, we pointed out that the actual number is closer to the 32 million figure. However, services should not be denied anyone, other than purely elective testing, diagnosis and treatment. Under healthcare reform, virtually every citizen is covered, and there is a reimbursement procedure in place for providers. In our opinion, employers of illegal aliens should reimburse providers for their services; providers and the rest of society should not be required to assume the financial risk.

Uninsured young adults are the largest single group of Americans (between 13 and 15 million) without health insurance. Their median income of $10,414 makes coverage unaffordable. According to the Commonwealth Fund, just over a million young adults, aged 26 and under, are now included under their parents’ healthcare policy under PPACA, whether in school or not, living at home or away, married or single. In 2014, when everyone is covered, another 7.2 million of this age group will gain coverage through Medicaid expansion and up to 4.9 million will gain subsidized private coverage through new insurance exchanges. Another 1.8 million young adults are not legal residents and will not be eligible for federally subsidized health insurance, as we understand the new law.

No denial for pre-existing conditions and no lifetime limits on healthcare expenditures. Pre-existing conditions cannot be a reason for denial of insurance coverage. Between now and 2014, those with pre-existing conditions can be assigned to high-risk pools, but coverage cannot be denied. After 2014, it appears as though the high-risk pools will disappear and everyone will be covered, regardless. While this is good for the consumer, insurers say it poses an actuarial problem, because the cost of extending such coverage is unknown. Thus, they are increasing premiums dramatically. Some believe they are taking advantage of the opportunity to raise prices prior to more stringent regulations.

The administration says that the costs to small and mid-sized employers and individual purchasers will be more aligned with those of large group insurance purchasers. It has long been customary that the larger the number of covered individuals, the larger the discount. Leverage with providers enables the large carriers to offer their product at a lower cost. Currently, individuals and smaller groups tend to make up the shortfall, but President Obama promises that that will change with PPACA.

Variations in healthcare premiums are allowed according to region, family size, age and smoking. In our opinion, other considerations should have been incorporated based upon risk and personal choices, with subsequent healthcare costs that would be spread to the remainder of the population. These could include high-risk behaviors like skydiving, motorcycles, reckless driving, etc. A region may be an area of the country as large as a state (e.g. Montana) or as small as a portion of a county in large metropolitan areas (e.g. Cook County). The government is favoring integrated delivery systems, which are forcing hospitals and physicians to form Accountable Care Organizations (ACO). We think that ACOs will evolve to function much like HMOs, even though others deny that will happen.

Rescission is no longer permitted. In other words, when a person is diagnosed with a disease or condition, they cannot have their policy cancelled. With no lifetime limits on healthcare expenditures, this provision should provide individuals with some peace of mind when they are facing a serious illness, but it should not be interpreted as “the sky is the limit” in all cases.

Rescission is no longer permitted. In other words, when a person is diagnosed with a disease or condition, they cannot have their policy cancelled. With no lifetime limits on healthcare expenditures, this provision should provide individuals with some peace of mind when they are facing a serious illness, but it should not be interpreted as “the sky is the limit” in all cases.

There is much more emphasis on primary care. Ideally, every person will have a medical home that will keep track of immunizations, screenings, medications and diagnoses through the electronic medical record. The medical home purportedly will remind the patient of recommended screenings (mammograms, blood work, physical exams) and when to refill medications. But the fly in the ointment is the shortage of professionals in the face of an influx of 32 million newly insured, plus 270 million already insured with no out-of-pocket for preventive care coverage. The gap is huge! Some estimate a primary care physician shortage of 60,000 by 2018.

Innovative approaches through the likes of Wal-Mart, CVS, Walgreens and others will most likely attempt to fill the void, but there are just not enough physicians and nurse practitioners to meet demand. Therefore, other, less highly trained individuals will likely be used in many of these settings. Could this lead to more cases of misdiagnosis, or failure to diagnose?

What about all of the false-positive tests that will require follow-ups from extensive screening? Remember, screening tests are designed to be inclusive with regard to screening for disease. Screening tests are followed by diagnostic testing, which is much more expensive.

Comparative effectiveness research. The Agency for Healthcare Research and Quality (AHRQ), a division of the U.S. Department of Health and Human Services, has been assigned several duties under the legislation; one is to provide for comparative effectiveness research. This compares newer, more costly treatments with those already on the market. Pharmaceutical-industry-backed research tends to compare new drugs with a placebo rather than older drugs for treatment of the same disease. That way, the drugs appear to have a more positive impact. It is hoped that AHRQ is isolated from political and special-interest pressures.

Transparency in financial relationships. Unfortunately, some healthcare providers have a tendency to refer patients for diagnostic testing and treatments based more upon their financial interests than evidence-based medicine. The law requires that providers disclose to patients any potential conflict of interest involving a financial relationship, such as physicians owning centers that provide CT scans, MRI scans or outpatient surgeries. It may even include ownership of stock in the publicly-traded healthcare sector. The referring professional is also supposed to provide a list of alternative, similar resources when there is a potential conflict.

Another provision that we think is good is that the portion of salaries for executives in the healthcare insurance business above $500,000 is not deductible. Some companies have paid out tens of millions of dollars to individuals in executive compensation. While it will not stop companies from continuing to pay out large sums, at least the taxpayer will not be subsidizing it; however, covered individuals will through their premiums.

THE BAD

THE BAD

And now, for those parts of the legislation that we don’t like, or that need to be massaged:

It’s unintelligible. The two bills signed by President Obama and not read by members of Congress before passage are well over 1,000 pages and riddled with references to other laws and regulations, making them too complex for mere mortals. Even those with years of experience in the health insurance business cannot understand many of the provisions in the legislation—nor the logic for many of them.

Several of the regulations and procedures ensuing from the legislation are still in the formative stages. Plus, the cost to other governmental agencies outside of Health & Human Services that are providing support is still being realized. For example, the Internal Revenue Service is requesting billions more per year in order to scrutinize income tax forms to determine who should be fined for not carrying health insurance. How many other governmental agencies, both state and federal, will require an infusion of resources—money, staffing, hardware, software, office space, etc.—not accounted for in the original legislation?

Defensive medicine. Conservative estimates suggest that defensive medicine amounts to at least 10 percent of healthcare costs. With healthcare costs at $2.6 trillion, that equates to $260 billion per year that physicians and hospitals spend unnecessarily just in case they should be sued. These costs reside in unnecessary specialist referrals, blood work, scans, x-rays, biopsies, office visits, medications and therapies. The healthcare reform bill virtually ignored this problem. The only reference is a five-year demonstration grant to states to develop, implement and evaluate alternatives to current tort litigation, giving preference to those that enhance patient safety, reduce medical errors and improve access to liability insurance. In other words, the costly malpractice problem resides solely within the quality of medical care. Political contributions pay off again! Even with a Republican-controlled Congress, President George W. Bush could not get meaningful tort reform passed.

Cost. The projected cost of healthcare reform is an additional $1.2 trillion over 10 years, with the majority of the funds being spent in the last six years. The really expensive items do not come on board until 2014. We believe the projected costs are conservative. There are two huge cost drivers. One is the aging population reaching Medicare eligibility; the other is research with new technology for diagnostic and treatment modalities.

The charts below represent the U.S. population in 1950 and 2009, respectively, in five-year age groups, with males on the left and females on the right. The population in 1950 has a symmetrical pyramidal shape, narrow at the top where the older population resides.

The 2009 figure shows a much larger older population, with much less mortality in all years. Older populations are extremely high utilizers of healthcare. Disease is an affliction of getting old, yet the healthcare budget calls for a $500 billion reduction from Medicare spending. How?

Sustainable growth rate (SGR). The Congressional Budget Office projected that the cost of healthcare over the 10-year period was actually going to be under budget by approximately $100 million. However, the projection assumed that physicians treating Medicare patients will accept a 29-percent reduction in reimbursements. That didn’t happen. Physicians are already opting out of caring for Medicare patients because the reimbursements are so low.

The problem is the SGR formula, established years ago by Congress to keep Medicare costs down by reducing physician reimbursement as overall costs go up. This antiquated formula does not reflect reality and should have been replaced long ago, but no one in Congress has the guts to do it. So they keep reimbursement levels the same by overriding the SGR on a piecemeal basis, as they did on December 1, 2010. However, because the SGR is current law, the government accountants continue to forecast the reduction in the budget. The accumulated budgetary deficit under the SGR is approximately $300 billion.

Research agenda. The United States is the medical research engine for the rest of the world. Today, we are probing and understanding the very molecules that cause the human machine to work. The cells that contain our DNA are revealing their secrets so physicians can understand disease processes, predict the future and tinker with ways to further prolong life. The inexpensive treatments and diagnostic modalities were discovered long ago—now we are getting into the really expensive stuff. We must either accept the fact that advances in medicine and our longevity are very expensive, or conclude that we cannot afford the cost of high-tech research. In our book, we call for an overhaul in how research is funded and conducted so that it will be more efficient, less costly, and meet the needs of Americans rather than being market-driven.

End of life. About 27 percent of Medicare’s budget is spent during the last year of life. Some of these expenditures are necessary because of uncertain outcomes and palliative care, yet some are made in hopeless cases, and only because “Medicare will pay for it.” An attempt was made to reimburse physicians who have advance directive discussions with patients, but because of the so-called “death panels” invented by reform opponents, the provision was dropped in the final legislation. This is a shame and a disservice to the patient, the profession and the taxpayer. Administratively, this is now being reintroduced with the physician being reimbursed on an annual basis for discussing living wills, advance directives and other patient options.

Employer involvement. Some employers are finding that it is less expensive to pay the penalty of $2,000 per employee than to provide health insurance. If this becomes the norm, then individuals will probably purchase the least expensive policies from those offered in the state exchanges. We would be surprised if the least expensive policies were not those offered by the federal government. The reason they are less expensive than private insurance policies is in part because their costs are not fully reflected in the premium. If the market for private insurance disappears, we will be left with a single payer system that will have no competition. Competition drives cost-effectiveness and responsiveness to the customer.

Excise tax. Would someone please explain to us how applying a federal excise tax to medications, insurance companies and medical devices will lower healthcare costs? Tax levies will be passed on to the consumers. By imposing an excise tax on insurance companies, the federal government is yet again directing the market toward a single payer system.

Summary

As we go to print, there are questions regarding the legality of mandated health insurance. Undoubtedly, this issue will be decided by the Supreme Court. If it is declared unconstitutional, we believe an alternative solution will be found. Alternatives could include an additional tax on everyone to make up for the lost premium, or as some have suggested, delaying eligibility for healthcare coverage for five years or until age 35 if initially rejected by the individual. Insurance companies lobbied for mandated health insurance. They make their money on what they don’t spend…and they need young healthy people in the system. Inclusion of all should lower premiums for the other folks.

We believe the cost of the PPACA is going to be much more than expected. Our thinking:

- Even though there is a stopgap measure to provide health insurance for those with pre-existing conditions, far fewer than anticipated have signed up. This could be due in part to the fact that the premiums and medical costs are much higher than was anticipated.

- PPACA projects a reduction of $500 billion for the next 10 years for Medicare. Without reducing benefits, we do not see how this can be achieved, considering the burgeoning numbers of elderly.

- Virtually all laypeople and the vast majority of physicians have only an inkling of the diagnostic, therapeutic and predictive modalities being developed or of those already in the pipeline. This new wave could dramatically impact the way medicine is practiced. It is technology-driven and extremely expensive. The biggest hurdle is not whether they will be developed, but how they are paid for.

- Unintended consequences are to be anticipated with this patchwork of ideas, laundry lists and special-interest accommodations. Compounding the problem are implementation regulations being developed and issued containing provisions not found in the PPACA. Unfortunately, neither those who developed the legislation nor those writing the regulations have had much practical experience in healthcare or its delivery.

- The major drivers of healthcare cost are still not being addressed, e.g. defensive medicine, pharmaceuticals, research agenda and funding, availability of insurance across state lines, risky behavior and lifestyle, etc.

- If there are any savings, they will be spent elsewhere instead of being placed in a trust fund for future use. We must elect responsible legislators who manage the government the way we manage our own business or household.

Unless we aggressively address the cost of healthcare, we will just be putting more debt on an already overburdened system. And we owe it to our children and grandchildren not to place more debt on their credit card.

It appears we now have two choices. We can start over, or we can massage the existing law and make it better for all of us. In our opinion, it would be best not to throw it out, lest we lose ground on the positive gains. Let’s preserve the favorable aspects of the legislation and incorporate needed changes. Positive changes could markedly simplify the language so that we mere mortals can understand it and result in actually controlling healthcare costs to an acceptable rate of inflation. This time, let’s keep the special interests at bay. After all, Congress has the perfect outline for healthcare reform in our book, Reasoned Health Care Reform. (Of course, there is no bias in that statement!) iBi

The authors wish to thank Mike Kepple, Curtis Freitag and Paula Keys from Kepple & Company; Dr. Rebecca Knight; Marlene Eller; Irene Crane and many others for their research and insights in preparing this article. Reasoned Health Care Reform is available on amazon.com and at I Know You Like A Book in Peoria Heights.